We Researched over 990 of the fastest growing B2B SaaS Companies to find out their growth strategies and mindset in 2022.

When we started in mid of May, we were specifically looking for,

- What was the Marketing Strategy in Enterprises v/s SMBs?

- The impact of Free Trials/Freemium Pricing Models on Growth Notions.

- State of Marketing at Product Led v/s Sales Led Notions

- Growth Channels are used primarily.

- How important is Customer Education to these teams?

We stitched answers to all of the above with facts and analysis, along with examples you can inspire from and act upon.

So, if you are someone who is confused and looking for a guide to reallocate marketing budgets during market uncertainty and confused by the polarised voices in the market like we were, keep reading.

Our effort has been to make this report the most transparent reflection of industry leaders’ activities for you to take reference from,

Now, these are the insights we found.

Summary of All Findings

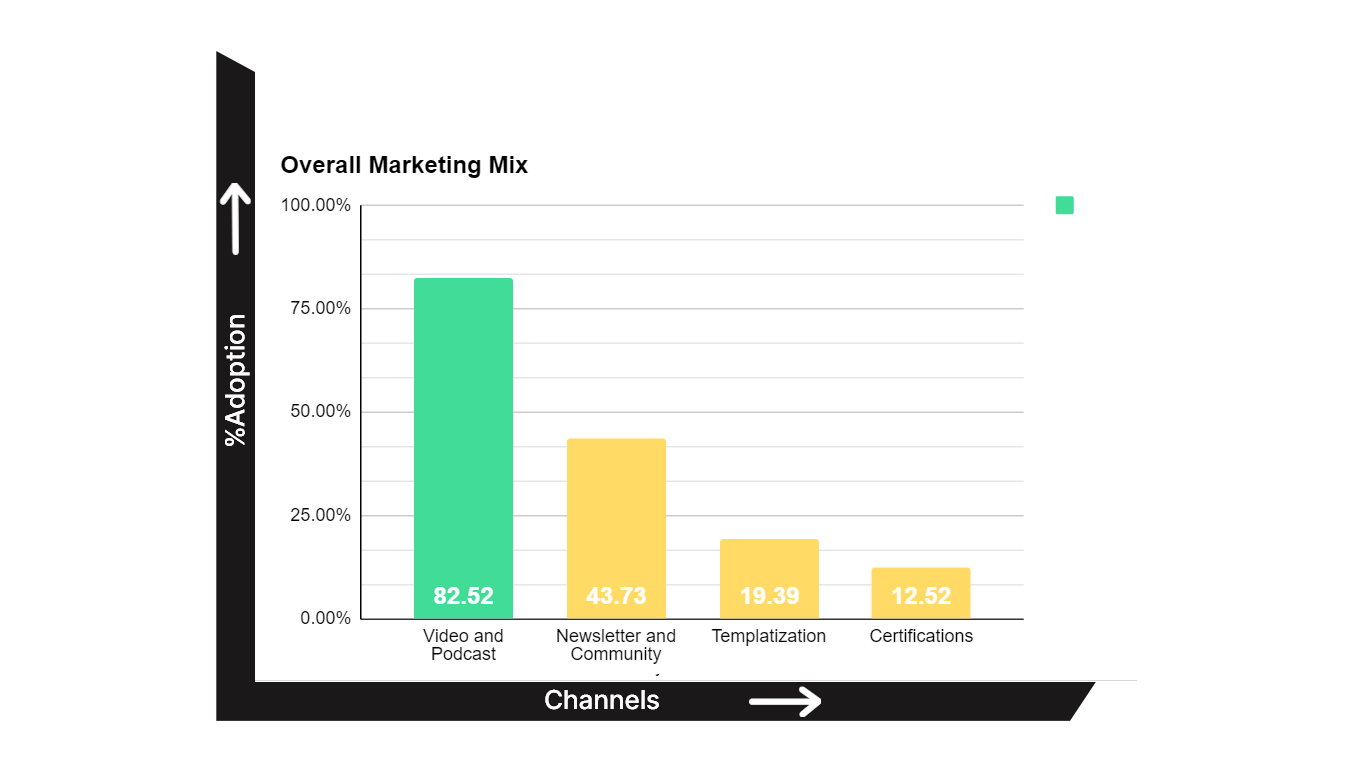

- Videos and Podcasts have emerged as the Primary Way(>70% for most businesses) to Deliver Content to Customers, Employees, and Partners across all high-growth organizations irrespective of size or strategy.

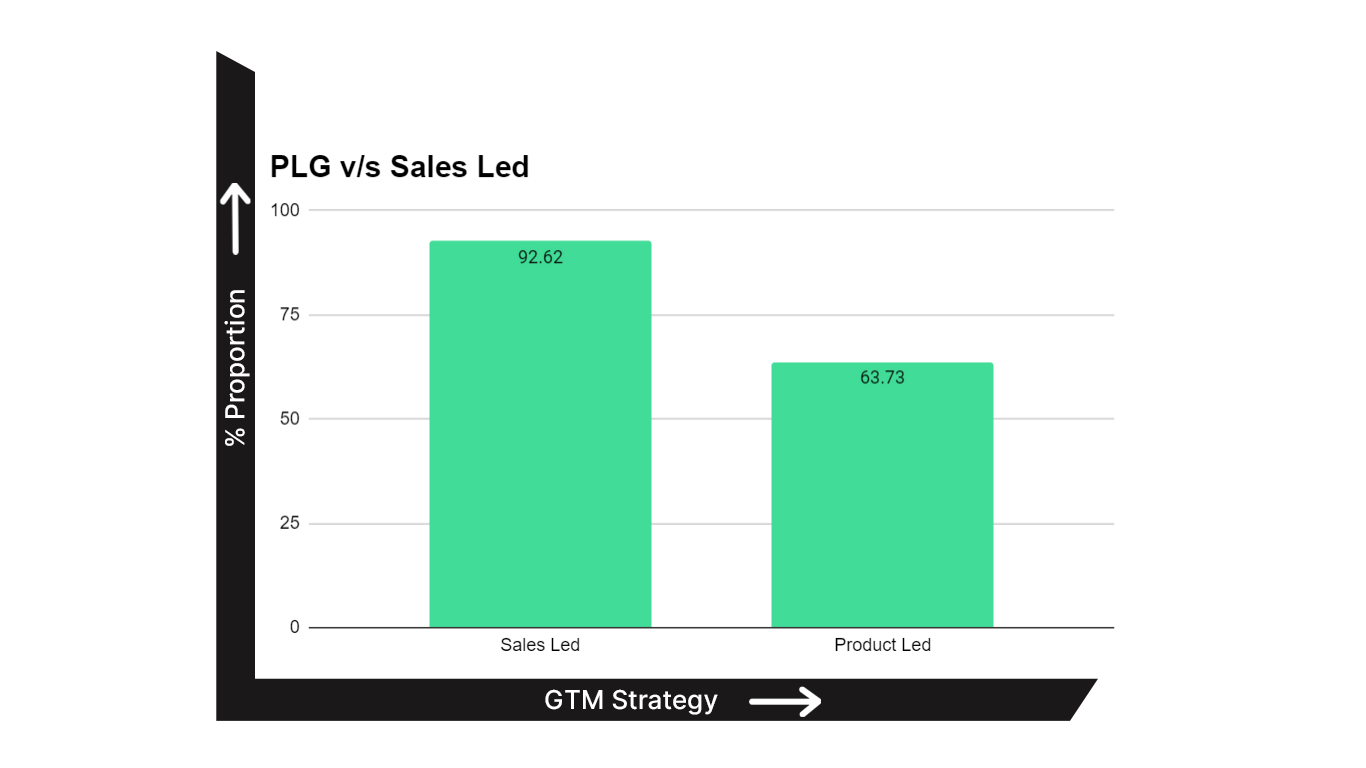

- Sales Led is by far the dominant ingredient in the Go To Market notion across high-growth B2B businesses at 92.62% but Product Led is quickly expanding its roots among these for a more efficient and seamless way of delivering customer experiences at 63.73%.

- Freemium remains an underutilized tactic both in Sales and Product Led Businesses in 2022, with freemium being at just 23.6% for PLG and 16.3% for Sales Led growth notions. This is true along with the fact that 94.6% of businesses offering freemium have Product Led notions(Obviously : )

- Templatization as a Product Marketing and Demand Generation tactic are starting to take off in 2022, used by 12.52%.

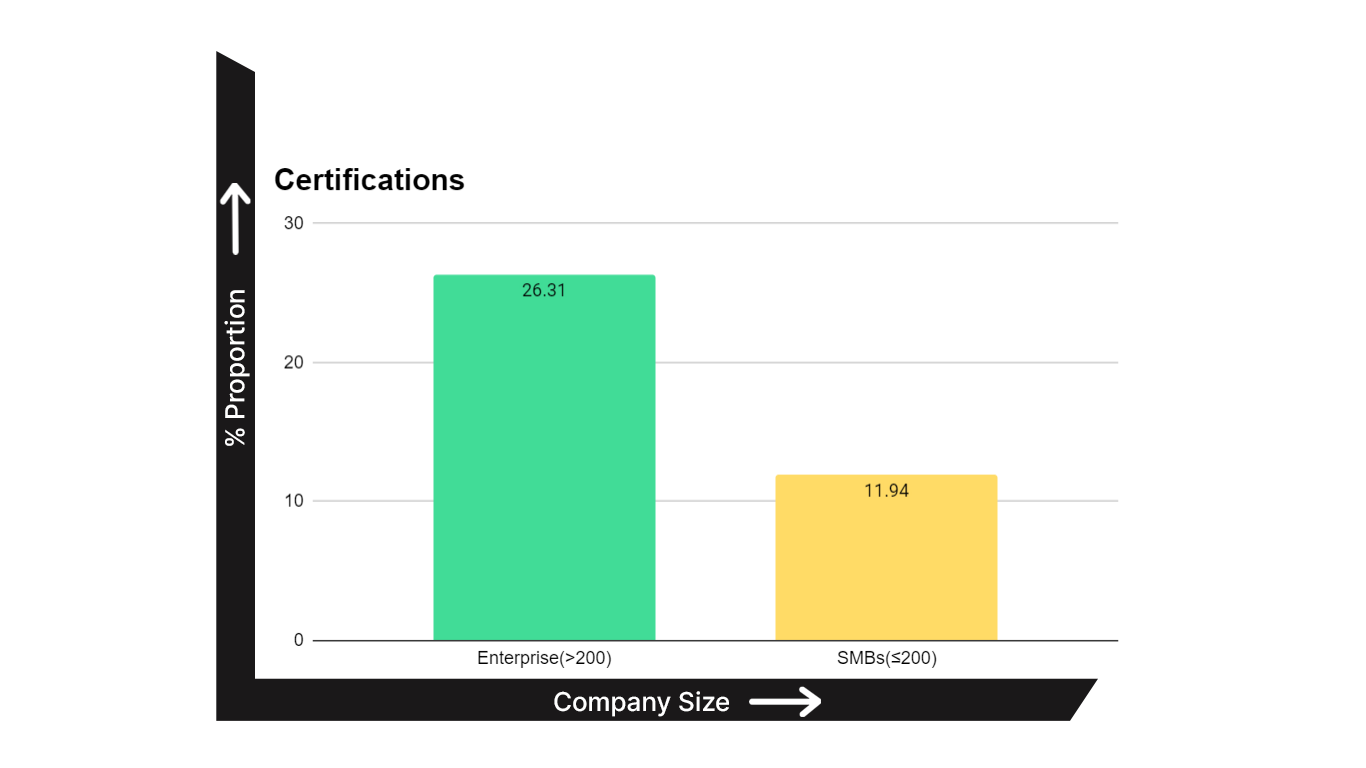

- A good chunk of 26.31% of the Enterprises is investing in Market Awareness and Customer Education through Certifications and Universities.

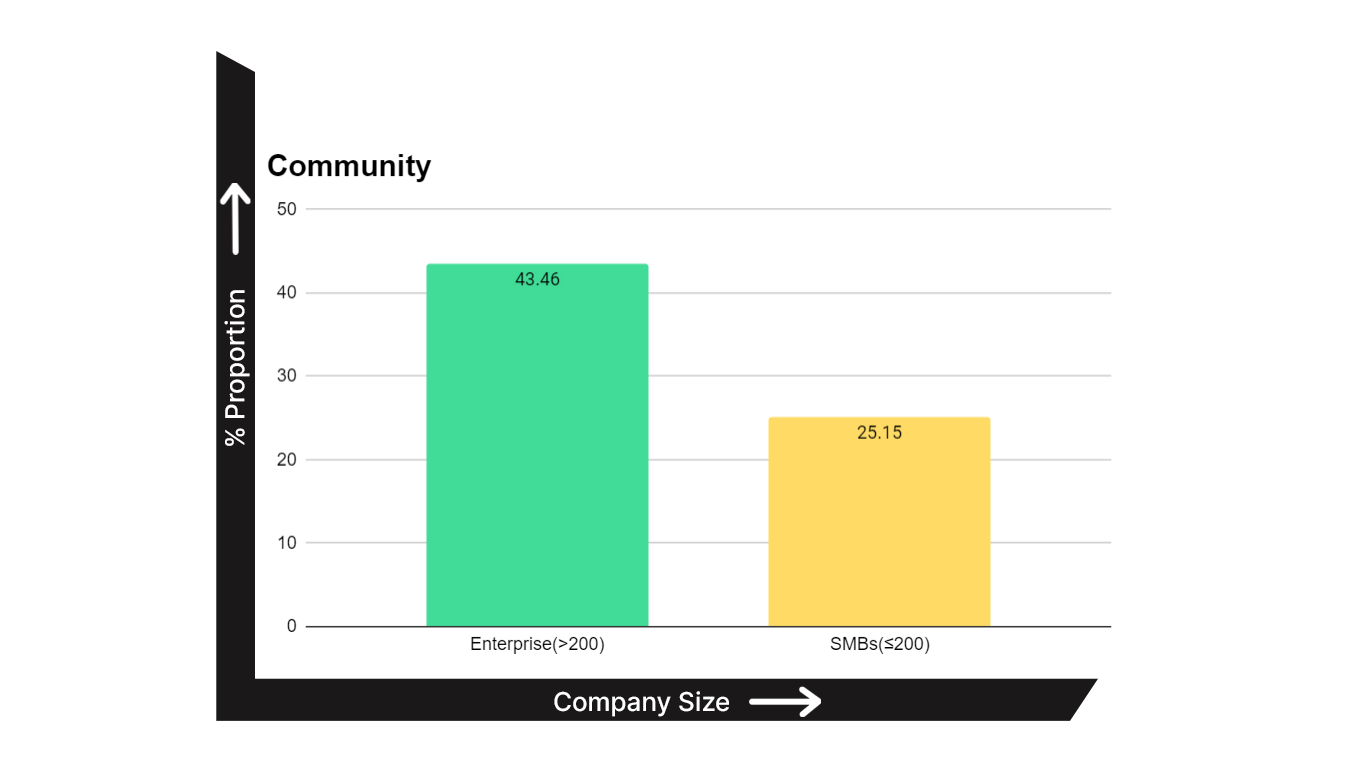

- Communities are on the Rise, especially for Enterprises at 43.46%. Also, Freemium businesses at 54.77% are using it to create evangelism and increase the quality of customer experience.

This is just the tip of the iceberg!

We looked at:

- Overall Growth Mix of the Study

- Growth Mix of Enterprises v/s SMBs

- Growth Mix of Product Led v/s Sales Led

- Impact of Free Trial v/s Freemium in the Sucess of B2B Businesses

Excited…? Let’s Go!

Now, these are the insights we found.

Podcast and Video Dominate Content

In our research, the most popular lever for content creation was found to be podcasts and videos(approximately used by double the no. of businesses), followed by newsletters, communities, and finally Templates and Certifications.

This reveals not only a dominating trend of Video and Audio in one place but also an opportunity for newer players to leverage channels like Templates and Community to stand out from the others.

*Enterprises like Yellow are using Videos in their content to resonate with their audience and do precise messaging.

Videos helped a lot in engagement, targeting, and partnerships. We could deliver crisp messaging which was mobile optimized in just 60 sec.

-Vibhanshu Dixit, Marketing at yellow.ai

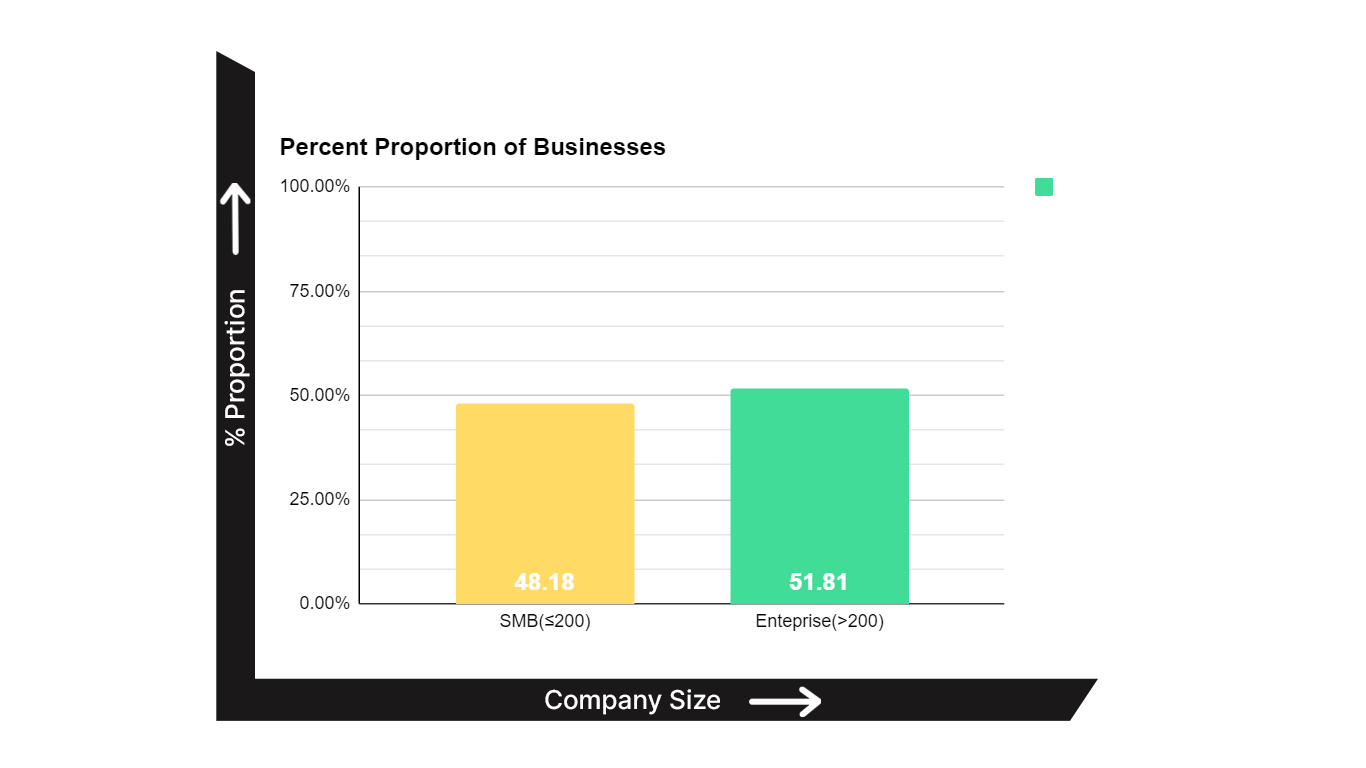

First of all, let’s take a look at the Distribution of Company Sizes to understand the relevance of the data. For this research, we have taken businesses with less than 200 employees as SMBs and the others as Enterprises.

With almost equal proportions of SMBs at 48.18% and Enterprises at 51.81%, the dataset was good enough for a fair analysis of the growth notions of these companies.

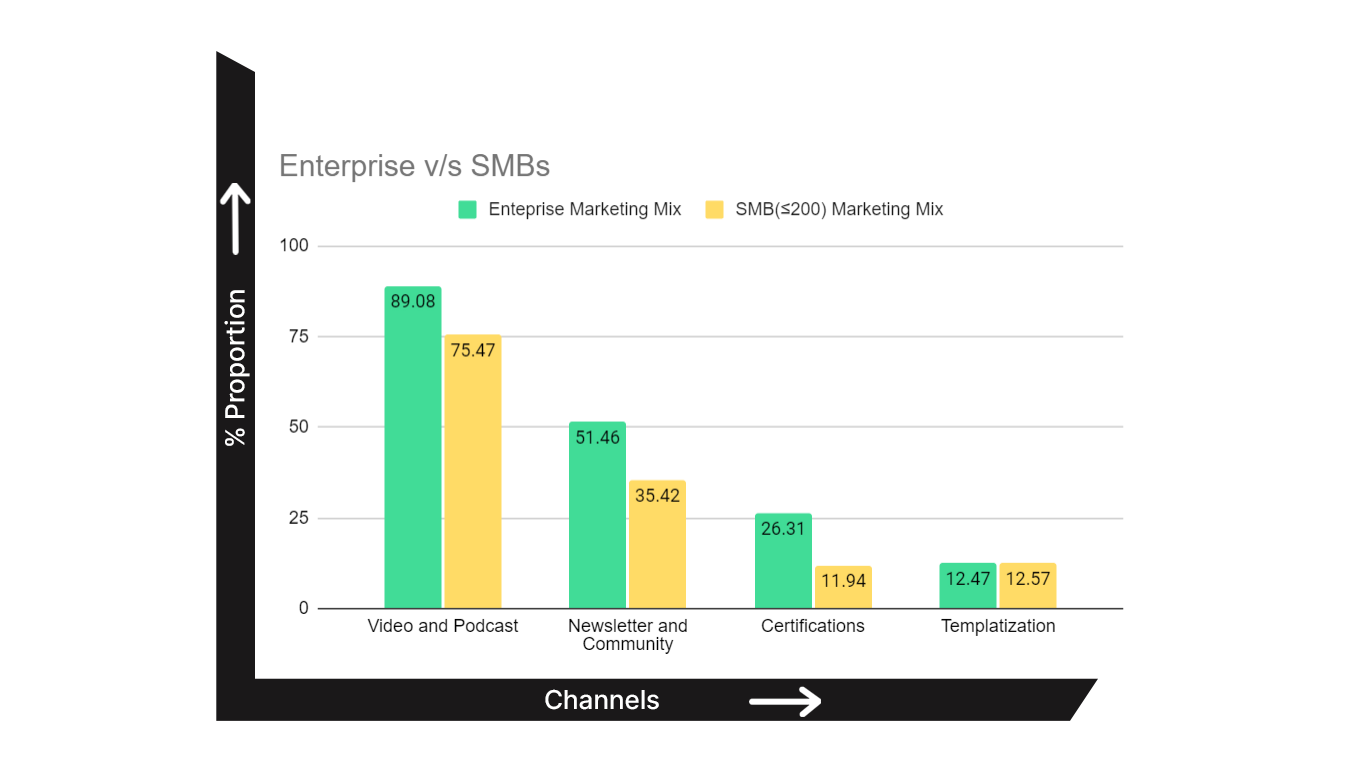

And what are the Marketing Levers these guys are using comparatively…?

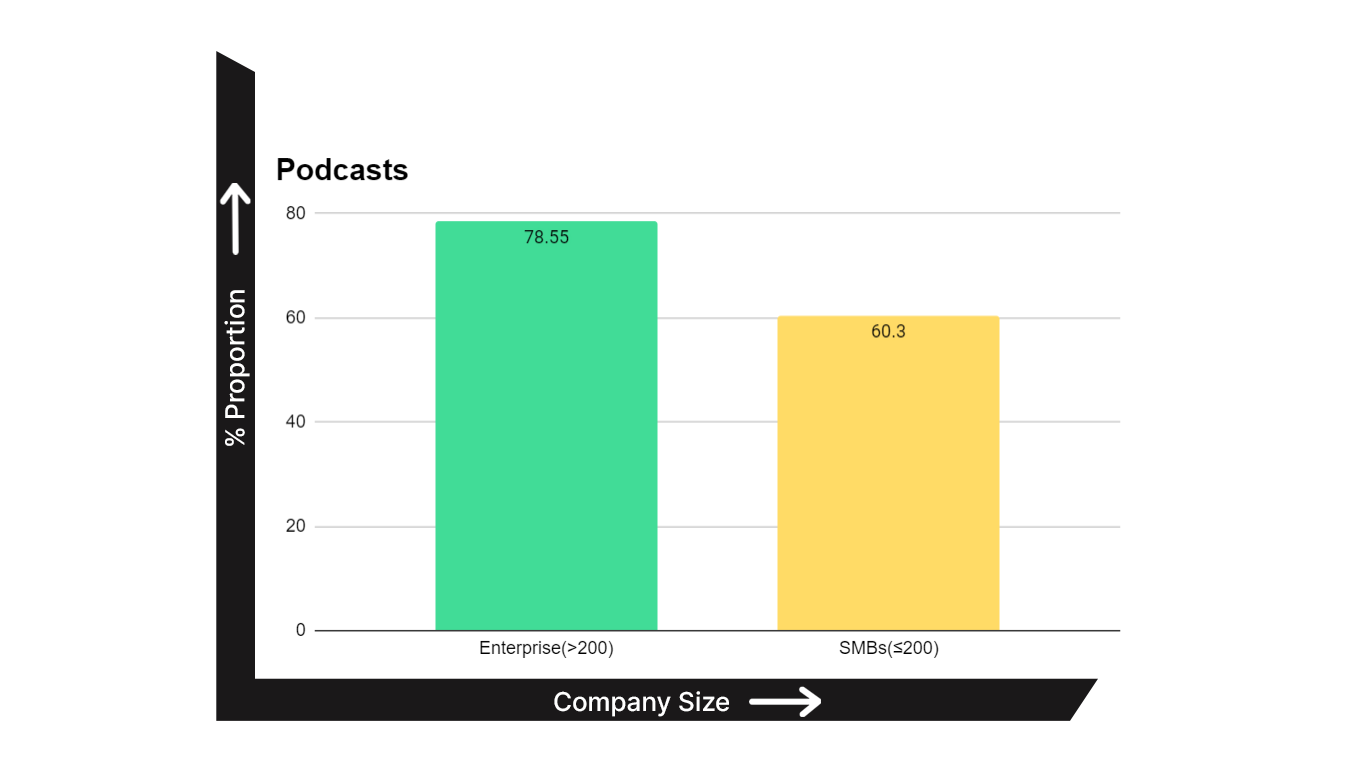

- 89.08% of Enterprises and 75.47% SMBs are using Videos or Podcasts.

- 51.46% of Enterprises and 35.42% Of SMBs are using Newsletters and Community.

- 26.31% of Enterprises and 11.94% SMBs are using Universities and Certifications.

More than double the Enterprises are using Certification programs. 26.31% of Enterprises and 11.94% SMBs use certifications and universities for their platforms and software.

Let’s dig a little deep into how these businesses are investing in Customer Education and Content Marketing.

More than double the Enterprises are using Certification programs than SMBs. 26.31% of Enterprises and 11.94% SMBs use certifications and universities for their platforms and software.

Stunning support for Podcasts was observed, with 78.55% of Enterprises and 60.3% of SMBs using Podcasts to deliver value and have better conversations with the customer.

But the Story of growth doesn’t end there,

It was pumping to see such a clear move towards community-led growth during our study.

A Massive number, 43.46% of Enterprises are using Communities for Growing their product, growth, and support notions, whereas the SMBs were at 25.15%.

Communities are Cost effective channels to build and engage authentic relations. They are a 2-way dialogue which help us to build products and awareness driving shared value…

– Jeremie Gluckman, b2b Community manager

TL;DR: Again our prior observation validates itself here, podcasts and videos are the favorite players for most high-growth businesses. Hence, you must differentiate by doing things most businesses cannot do, or won’t do.

There are piling amount of discussions in the industry around how Product-Led and Sales Led work, separately and together.

Let us evaluate how these businesses are going with the same.

- 63.73% of businesses had Product Led Notions to grow while,

- 92.62% had Sales Led Growth in one or the other form.

*Note that 3.5% of the studied businesses were entirely Product Led, while 35%(10x Pure PLG) businesses were purely Sales Led.

Also, we found that

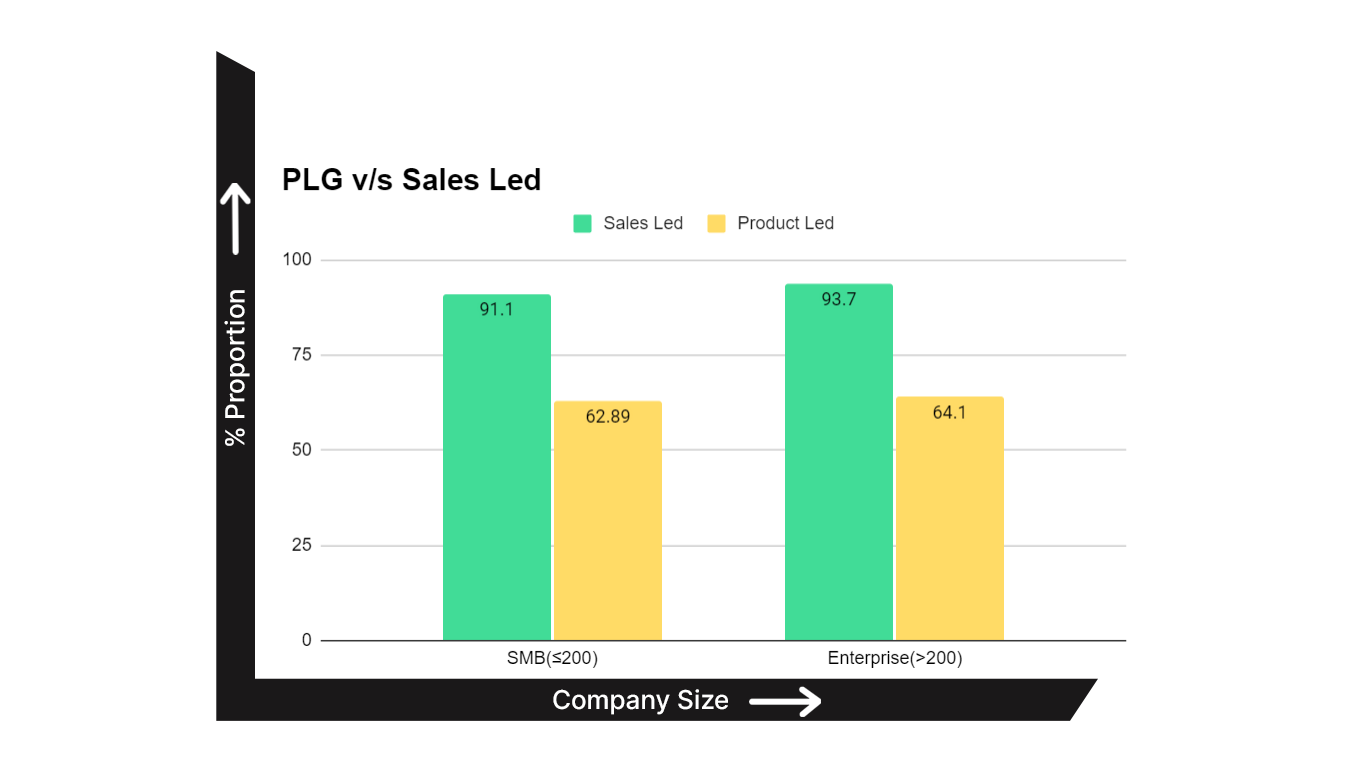

- 62.89% of SMBs were using PLG and 91.1% had Sales Led Growth.

- While 64.1% and 93.7% of Enterprises were using Product Led Growth and Sales Led Growth respectively.

Let’s see the comparison of marketing levers by Sales Led and Product Led Notions (Which I’m going to take the liberty to call SLG and PLG here 🙂

- 84.6% of PLG and 85.38% of SLG are implementing Video Content or Podcasts.

- 50.55% of PLG and 44.9% Of SLG are Using newsletters or community

- 20.44% of PLG and 17.54% of SLG are using Universities and Certifications

Want to hear something surprising…?

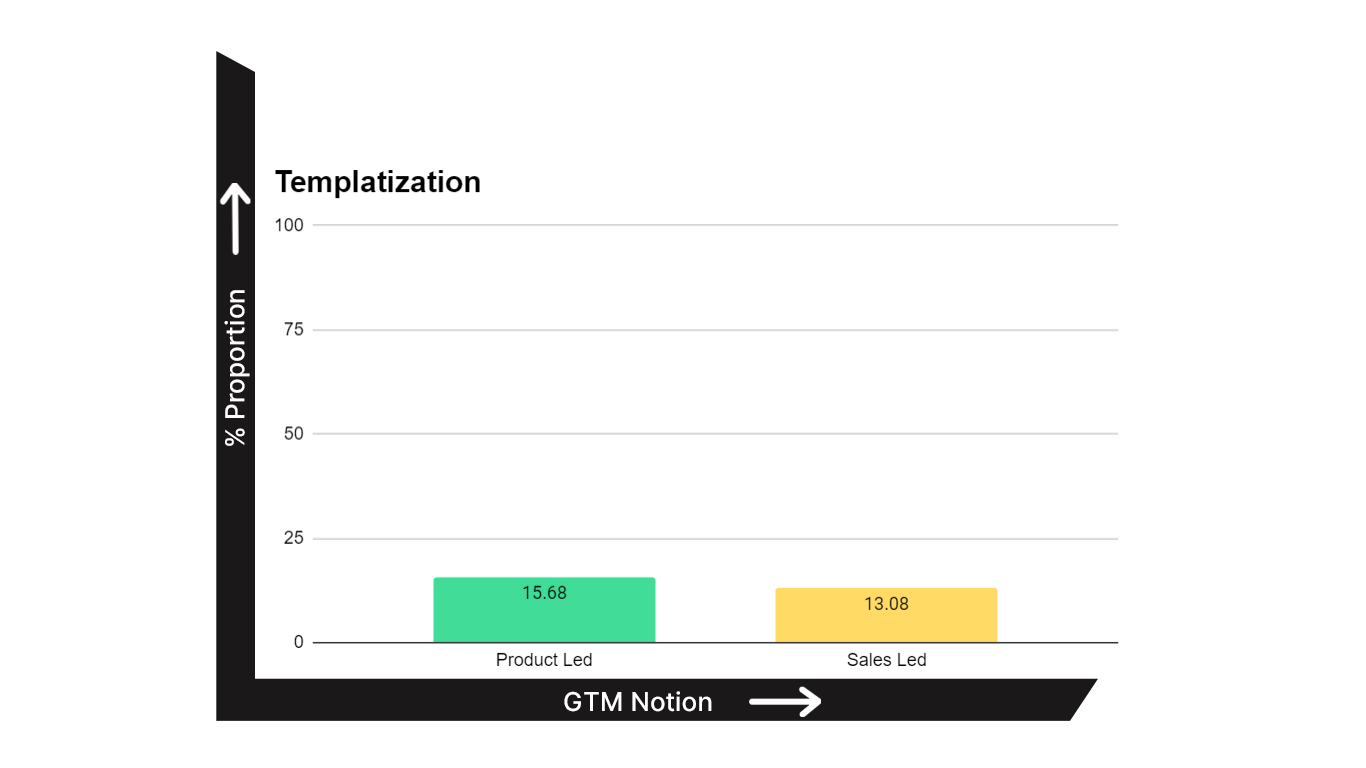

Templatization was massively underutilized both in Sales Led and Product Led Notions, Practiced at 15.68% and 13.08% for Product Led and Sales Led businesses respectively.

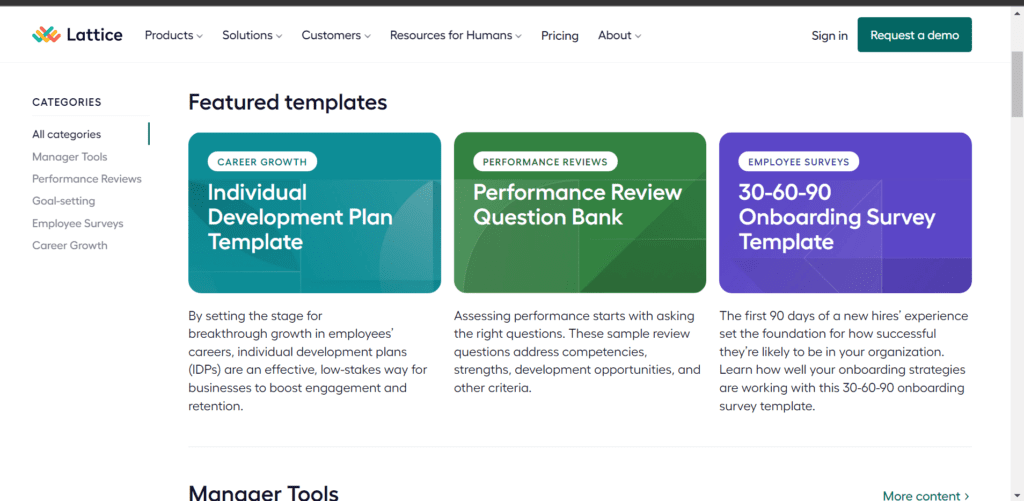

*But even after being implemented by a few, Enterprises like Lattice(a people success platform) are distributing templates for performance review, employee onboarding, and personal improvement of manpower and processes across businesses and educating them on their unique value as a product.

TL;DR: Sales Led notion is majorly adopted(>90%) by most businesses. Product-led businesses do have an upper hand over Sales Led businesses in leveraging communities and customer education, but still templatizing the platform’s capabilities for Brand Awareness, Education, and Better Customer Onboarding and Experience has a huge gap in the market.

One of the biggest dilemmas in the B2B SaaS industry is “Pricing”.

Let’s find some answers through the fastest-growing companies in the space.

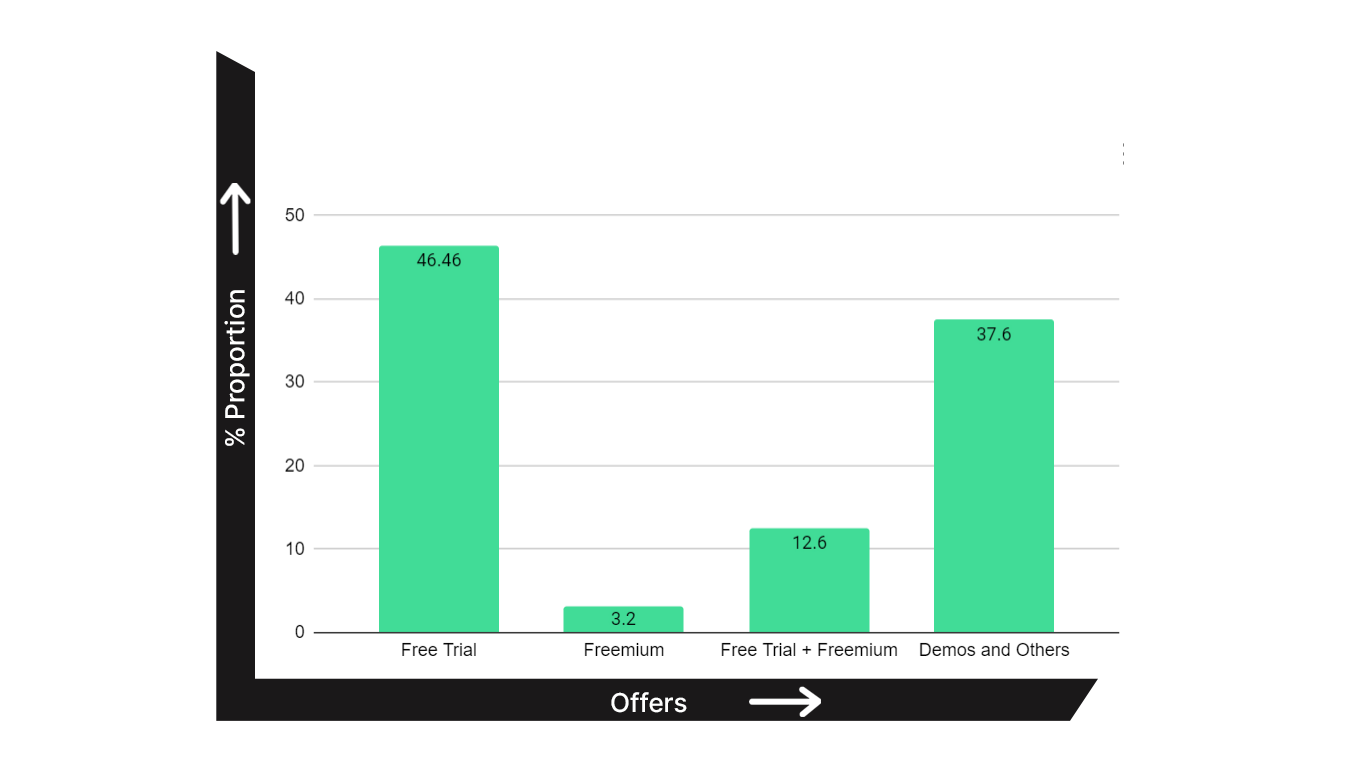

- Free Trial dominated as part of the offering, with 46.46% of businesses using it, the secondary majority were Demos, Installs, and others at 37.6%.

- Freemium was opted for by 15.85% of businesses,

- 12.6% offered both Free Plans and Free Trials.

Now the question is, what kind of companies are using Free Trials or Freemium Offerings,

- How big are they?

- What is their GTM Strategy?

- What kind of Marketing Levers are used by them?

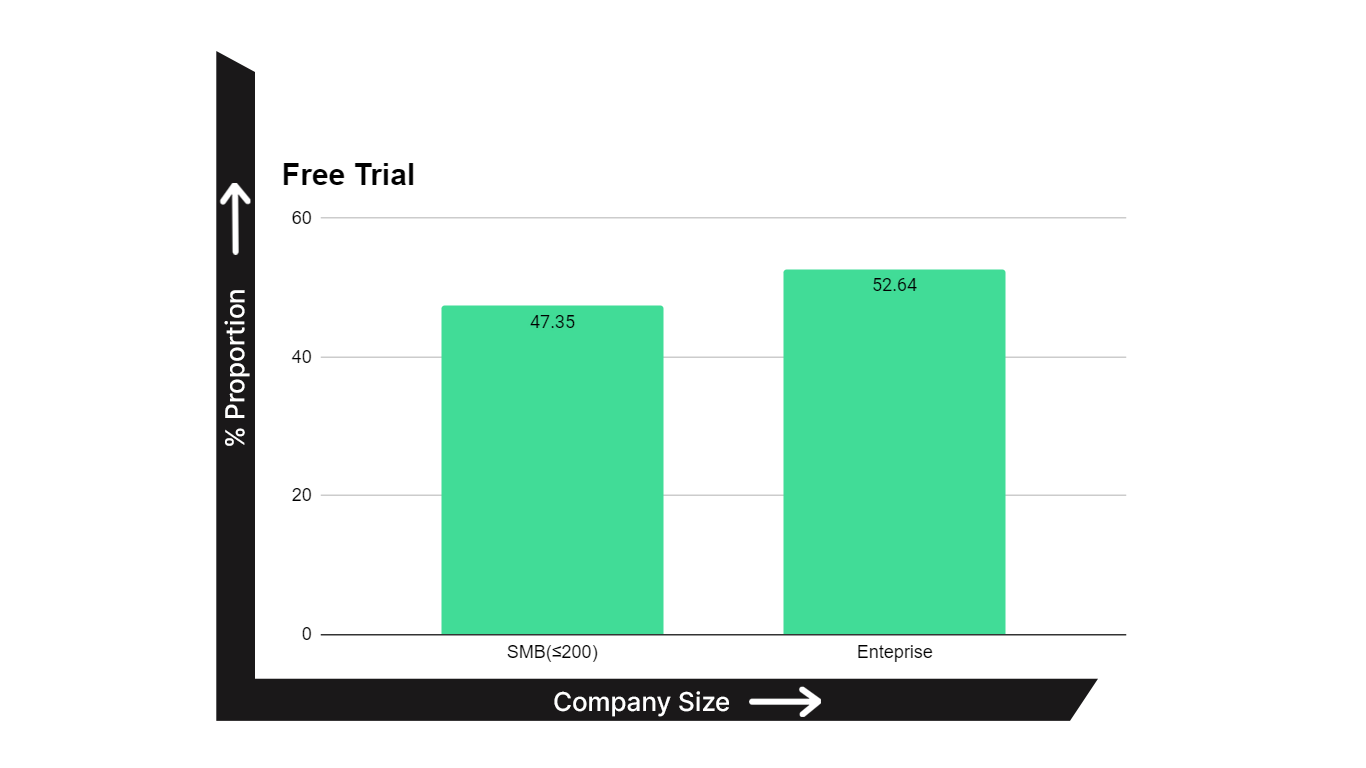

Of the businesses offering Free Trials, 47.35% were SMBs, and 52.64% were Enterprises.

*An interesting note is that we found that 60.03% of all Enterprises were offering Free Trials.

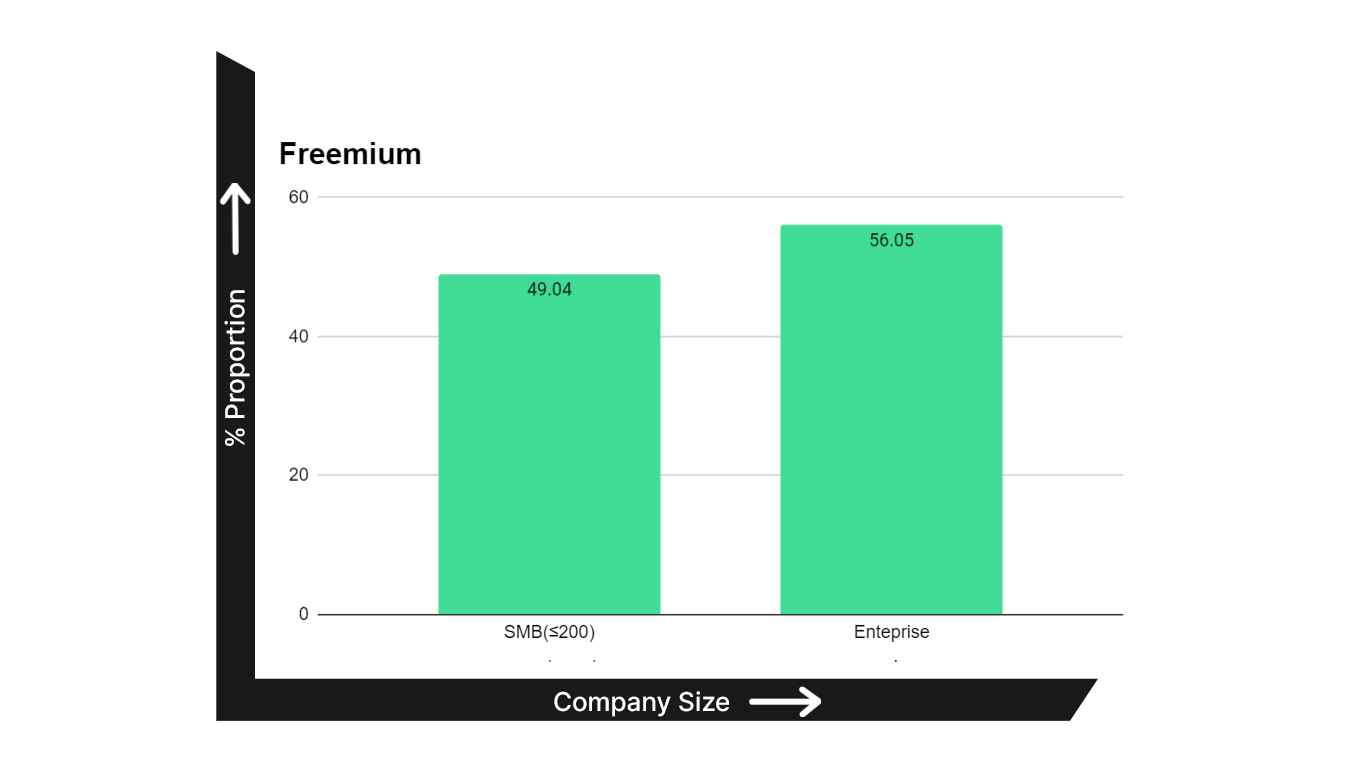

While we found that of all the businesses offering freemium, 56.05% were Enterprises and 49.04% were SMBs.

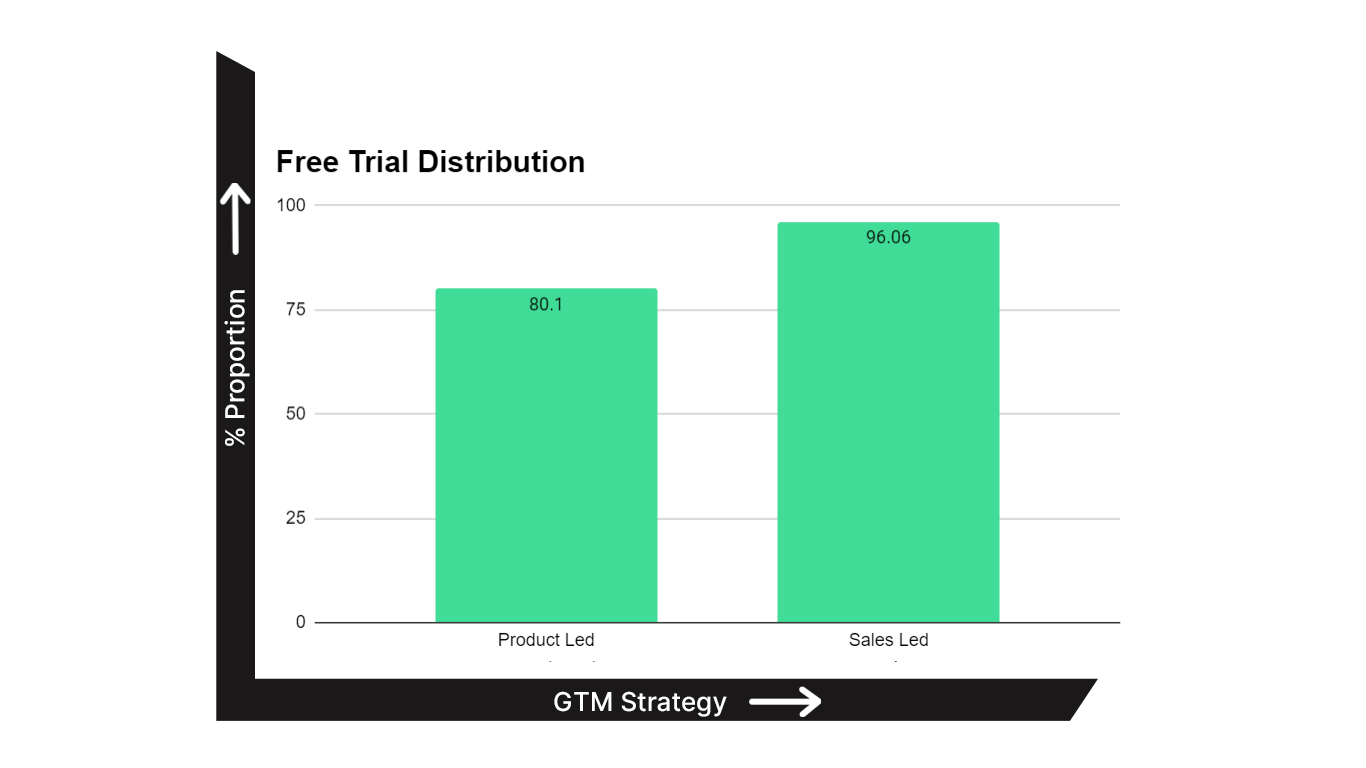

Sales Led businesses dominated the Free Trial offer, with 96.06% of businesses offering Free Trials having Sales Led Growth Notions for their GTM.

But, the fantastic thing is that 80.1% of businesses offering Free Trials used Product Led Growth Notions too.

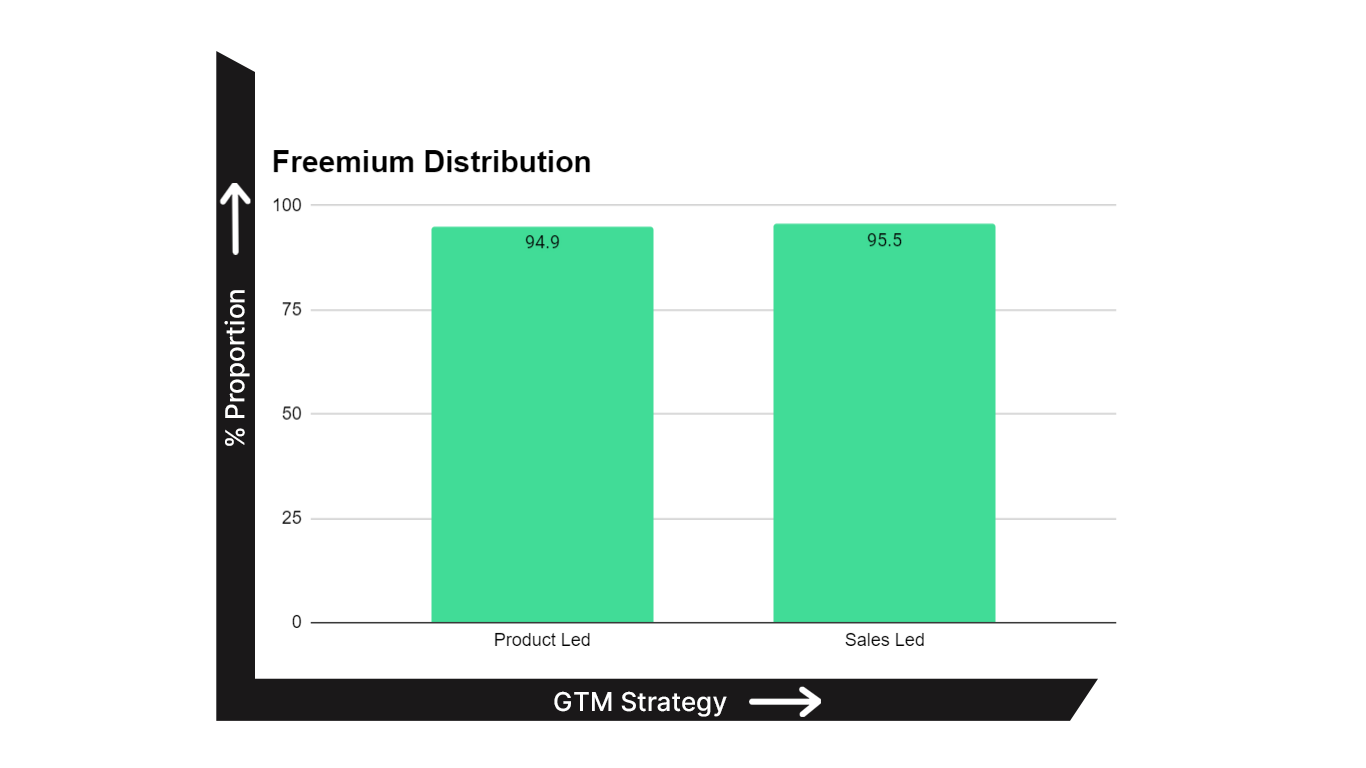

Freemium and Free Trials had very similar distribution among Product Led and Sales Led businesses.

While 94.9% of Freemium offerings had PLG notions and 95.5% had Sales Led businesses.

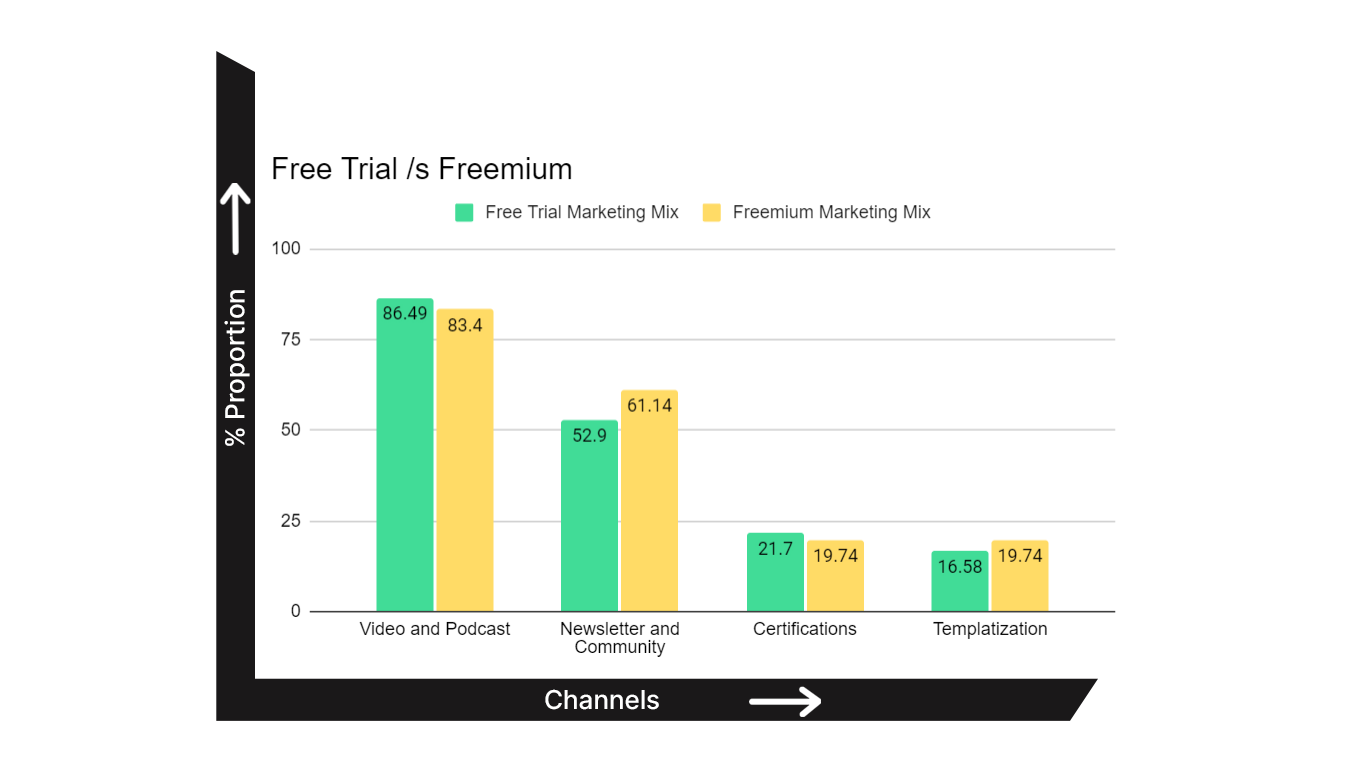

Considerable investment was observed in the form of Newsletters and Communities, used by 52.9% of Free trial offering businesses and 61.14% of Freemium offering businesses.

*The interesting note here is, that Freemium offerings outperformed Free Trial in Templatization, with 19.74% of Freemium businesses using templates on their platform.

Also, an interesting thing for Community Enthusiasts is…,

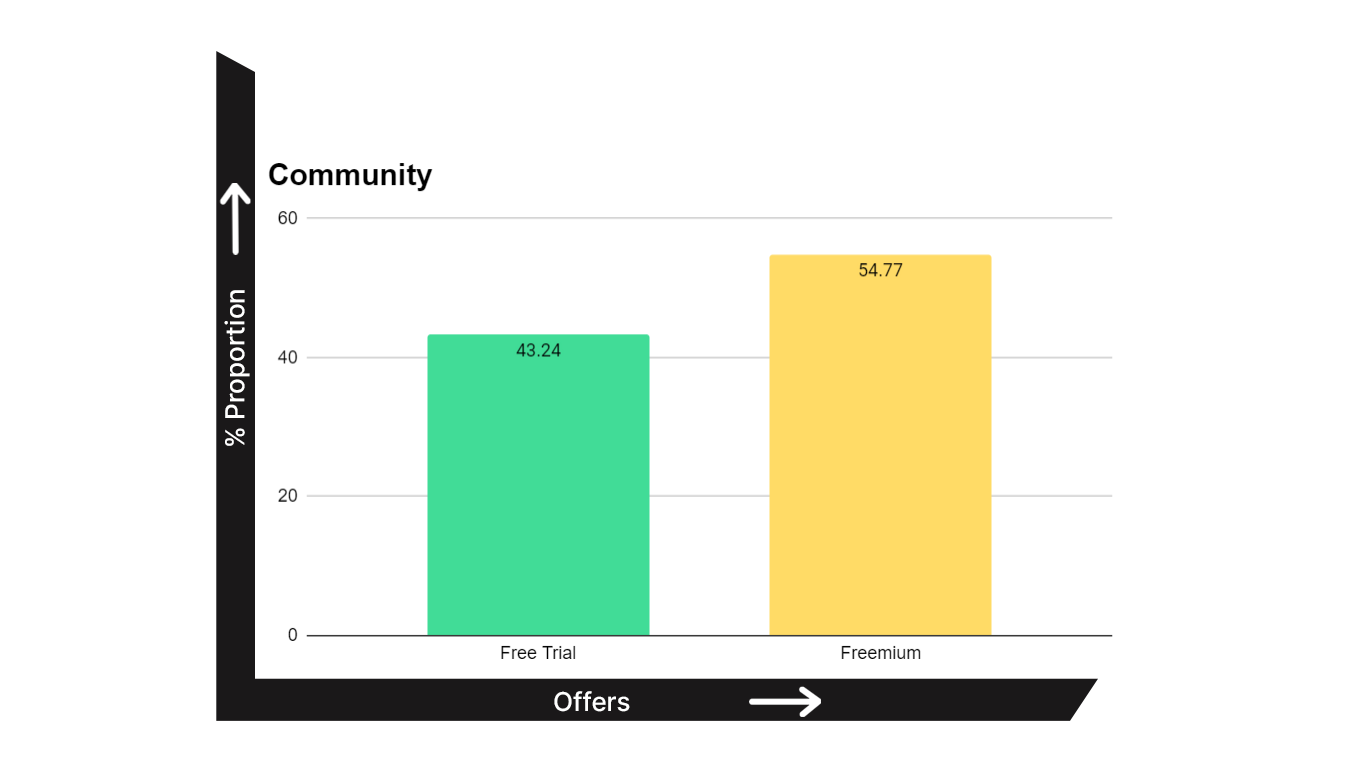

*Freemium offering businesses are investing heavily in Communities much more than Free Trial businesses, standing at 54.77% and 43.24% of businesses respectively.

TL;DR: Freemium is still a point of exploration and adoption amongst the majority of B2B Tech businesses, the market is dominated by Free Trials, Demo Requests, and Installs. But the companies adopting Freemium are investing at higher proportions into Community, Templatization, and overall Customer Education than other Pricing offers.

Conclusion

This was an amazing experience for us, we came to know so much about the real state of growth in our B2B SaaS industry, so much more than discussions and opinions.

We are grateful to the whole PeerSignal Team, and to Adam Schoenfeld(Co-Founder at PeerSignal) for building such a great tool for customer research and data of your Ideal Customer Profile. We would definitely recommend checking them out.

Now it’s your turn, what will be your biggest takeaway from this study?

Any add-ons, or counters? Would love to hear you out!